Social Security Max Income Tax 2024

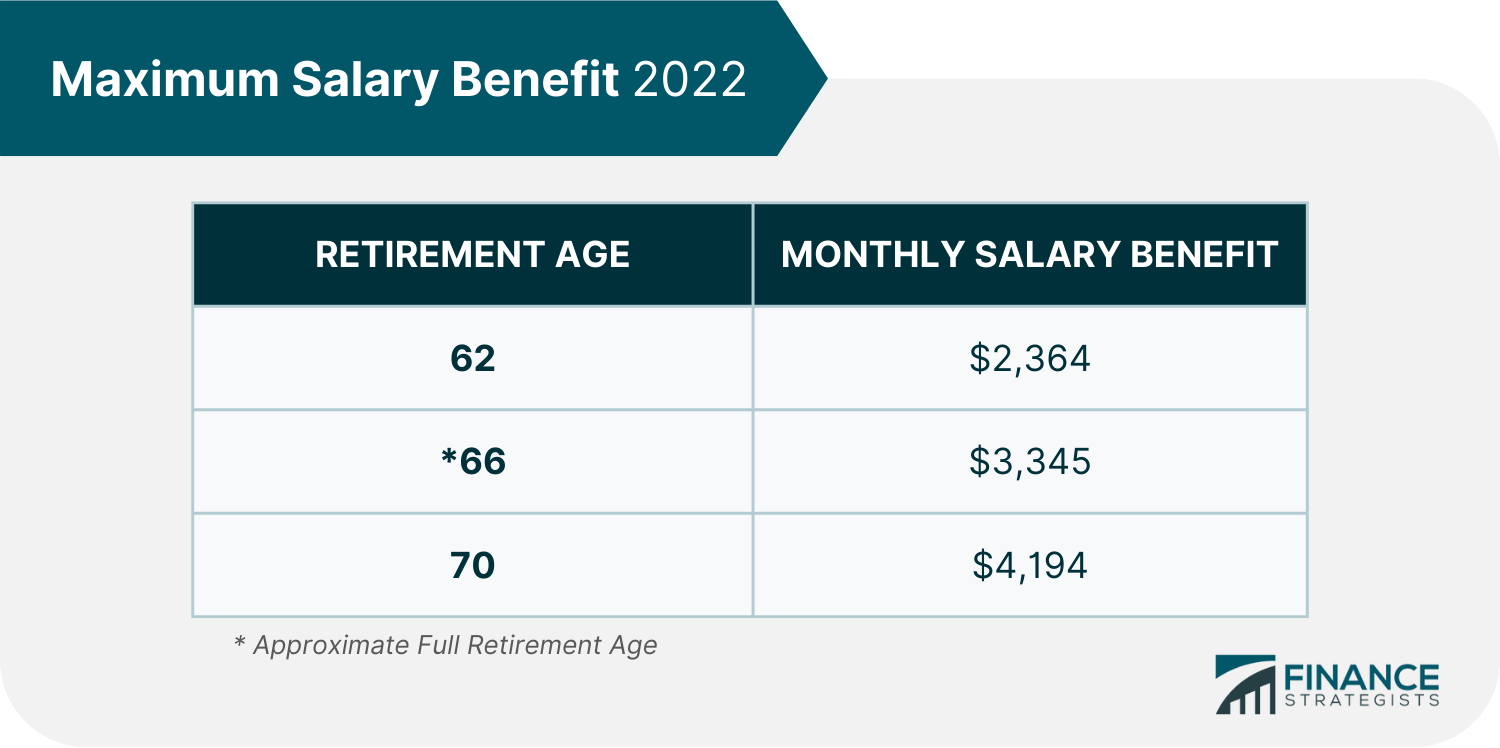

Social Security Max Income Tax 2024. That's because the irs adjusts the maximum earnings threshold for social security each year to keep up with inflation. The maximum social security benefit in 2024 is $3,822 per month at full retirement age.

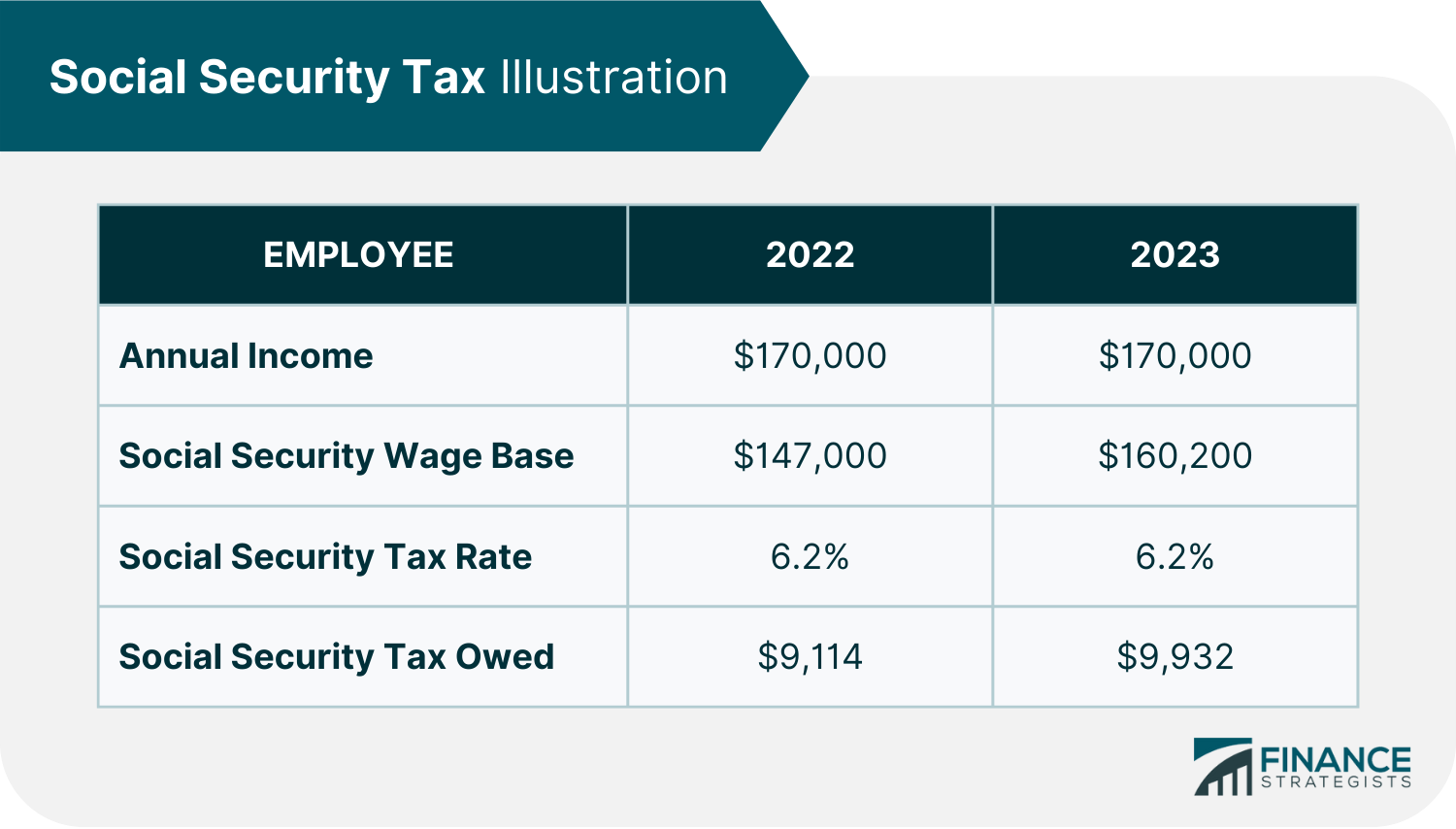

Workers earning less than this limit pay a 6.2% tax on their earnings. The tax rate for an employee’s portion of the social security tax is 6.2%.

In 2024, The Maximum Amount Of Earnings On Which You Must Pay Social Security Tax Is $168,600.

That's because the irs adjusts the maximum earnings threshold for social security each year to keep up with inflation.

The Maximum Social Security Benefit You Can Receive In 2024 Ranges From $2,710 To $4,873.

Only the social security tax has a wage base limit.

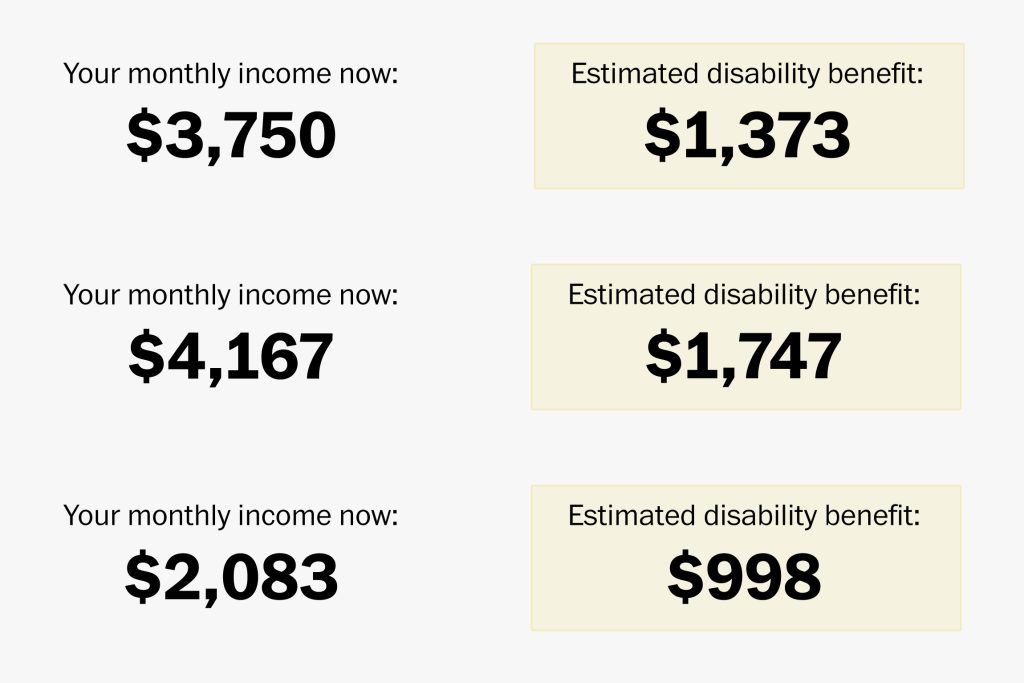

For 2024 That Limit Is $22,320.

Images References :

Source: annnorawgrace.pages.dev

Source: annnorawgrace.pages.dev

Social Security Maximum Taxable Earnings 2024 Diann Florina, This amount is known as the “maximum taxable earnings” and changes. The maximum social security benefit in 2024 is $3,822 per month at full retirement age.

Source: emmaleewelane.pages.dev

Source: emmaleewelane.pages.dev

Limit On Social Security Tax 2024 Kelcy Melinde, That’s what you will pay if you earn $168,600 or more. Of all the states that won’t tax social security income in 2024, the state that scores the least on our list is california.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

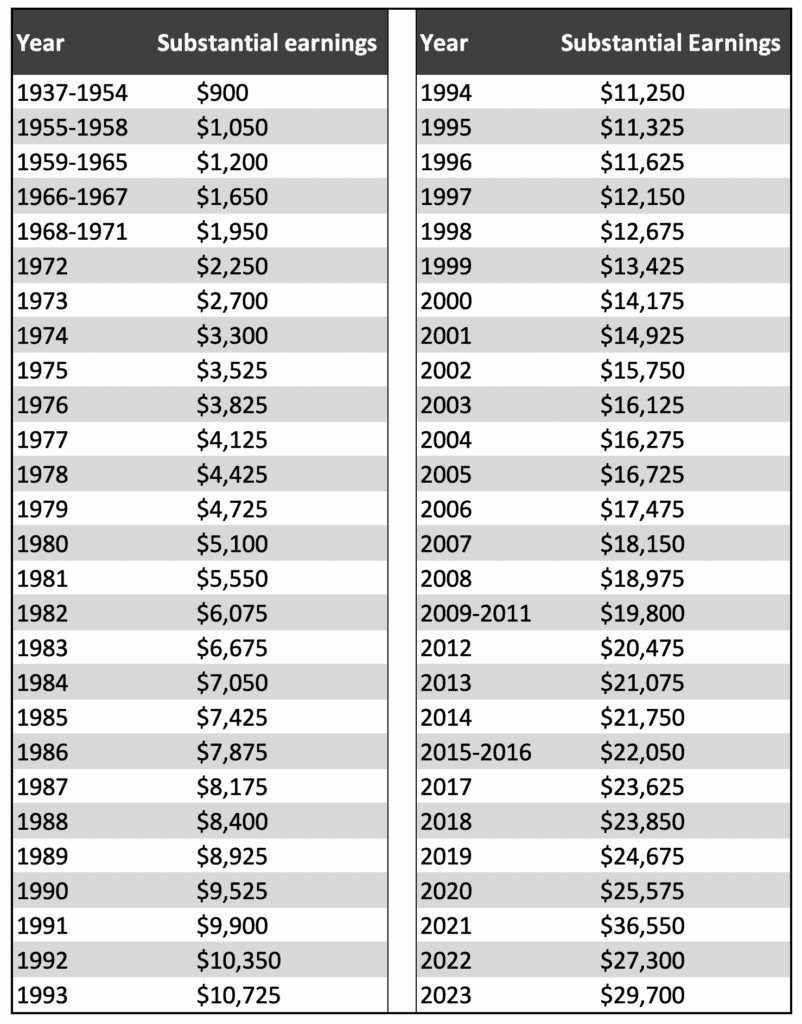

Maximum Taxable Amount For Social Security Tax (FICA), We raise this amount yearly to keep pace with increases in average wages. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Source: shaunawtove.pages.dev

Source: shaunawtove.pages.dev

2024 Social Security Disability Earnings Limit Roxy Wendye, In 2024, you can earn up to $22,320 without having your social security benefits withheld. Your employer also pays 6.2% on any taxable wages.

Source: www.youtube.com

Source: www.youtube.com

SOCIAL SECURITY UPDATE 168,600 New Social Security Maximum Taxable, We call this annual limit the contribution and benefit base. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

Source: marybethwgisele.pages.dev

Source: marybethwgisele.pages.dev

Social Security Earnings Limit For 2024 Eda, Your employer also pays 6.2% on any taxable wages. If your social security income is taxable, the amount you pay will depend on your total combined retirement income.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), We call this annual limit the contribution and benefit base. The most you will have to pay in social security taxes for 2024 will be $10,453.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, This amount is known as the “maximum taxable earnings” and changes. Individuals with multiple income sources.

Source: www.youtube.com

Source: www.youtube.com

168,600 New Social Security Maximum Taxable Earnings in 2024 YouTube, The wage base limit is the maximum wage that's subject to the tax for that year. The irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits.

Source: www.youtube.com

Source: www.youtube.com

5.2 Increase to Social Security Maximum Taxable Earnings in 2024 YouTube, Your employer also pays 6.2% on any taxable wages. The limit is $22,320 in 2024.

11 Rows If You Are Working, There Is A Limit On The Amount Of Your Earnings That Is Taxed By Social Security.

Your employer also pays 6.2% on any taxable wages.

The Irs Reminds Taxpayers Receiving Social Security Benefits That They May Have To Pay Federal Income Tax On A Portion Of Those Benefits.

Individuals with multiple income sources.